IRS Tax Seminars on 4/29 & 30 - Experts Reveal Tax Saving Secrets for You!

Join us for an extraordinary opportunity to engage face-to-face with IRS tax experts who are making a special journey from California to Boston and New York! Imagine having your tax questions answered by professionals with firsthand knowledge and experience straight from the source.

Alongside IRS representatives, we will be featuring leading local CPAs and attorneys. Their deep expertise in tax matters, coupled with their understanding of the local landscape, ensures that you'll receive comprehensive insights and guidance tailored to your needs.

The seminars will be conducted in both Mandarin and English. We are breaking down language barriers to ensure that everyone can access valuable tax knowledge. With four sessions strategically arranged across two days, we're making it easier for you to participate.

Six local leading organizations unite to bring you this exclusive event. With resources pooled from industry leaders, it's an opportunity like no other.

Who Should Participate?

- Small Business Owners: Get expert tax insights to optimize your business finances. Discover strategic tax planning techniques, learn about available deductions, and ensure compliance with the latest regulations to optimize your business's financial health.

- Professionals: Stay updated on industry trends, and gain practical strategies for tax optimization. From maximizing deductions to planning for future tax liabilities, empower yourself with the tools you need for financial success.

- New Immigrants: Our bilingual presentations provide a welcoming space for new immigrants to learn about their tax obligations, explore available resources, and gain confidence in managing their finances in the United States.

- Students and Recent Graduates: As you embark on your professional journey, understanding tax basics is essential for building a strong financial foundation. Join us to kickstart your financial know-how and explore tax-related careers.

No matter your background or experience level, our seminar series offers something for everyone. Join us for practical tips, expert advice, and networking opportunities. Register now!

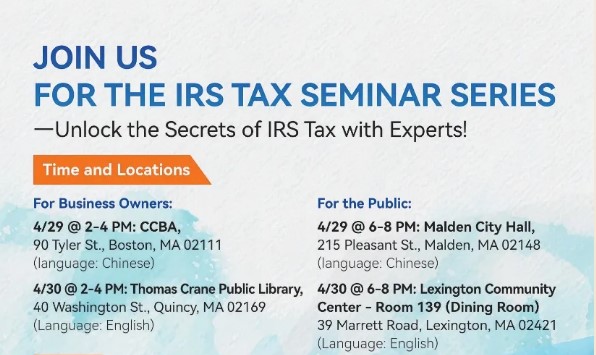

Seminar Information

This seminar series will consist of four sessions, including bilingual presentations in both Mandarin and English.

For Business Owners:

- April 29,2:00 PM, CCBA, 90 Tyler Street, Boston, MA 02111 (In Chinese)

- April 30,2:00 PM, Thomas Crane Public Library, 40 Washington Street, Quincy, MA 02169 (In English)

For The Public:

- April 29,6:00 PM, Malden City Hall, 215 Pleasant Street, Malden, MA 02148 (In Chinese)

- April 30,6:00 PM, Lexington Community Center - Room 139, 39 Marrett Road, Lexington, MA 02421 (In English)

Registration:

Please click HERE or scan the QR code below to register.

Speakers

Susanne Guo

Sr. Stakeholder Liaison and Bilingual Tax Specialist with IRS

Susanne Guo is a Sr. Stakeholder Liaison and Bilingual Tax Specialist with the Internal Revenue Service (IRS) She is fluent in both Cantonese and Mandarin Chinese and is a licensed Certified Public Accountant in state of California.

Before her current role, Susanne worked as a Revenue Agent in the Small Business and Self-Employed field exam and was a member of the Abusive Tax Transaction Specialty Group. With over 15 years of experience at the IRS, Susanne has developed a comprehensive understanding of the policies, procedures, and work processes within the organization.

Susanne’s bilingual background and expertise enable her effectively service taxpayers from diverse cultural backgrounds, while providing them with necessary guidance and support to navigate the complexities of the US tax system.

Yong Li

Bilingual Stakeholder Liaison Tax Specialist with IRS

Yong Li is a bilingual Stakeholder Liaison Tax Specialist with the Internal Revenue Service. As a bilingual Chinese Stakeholder Liaison, he collaborates, informs and communicates priority outreach messages to all taxpayer communities, including major employers, community associations and tax practitioner organizations to provide significant messages that impact taxpayers to ensure compliance with the tax laws.

Yong became a Stakeholder Liaison in 2021. Prior to that, he has held positions in IRS Small Business Self Employed Division as a Revenue Agent in field exam, tax return selection, and case processing. He has worked for the IRS for over 15 years. During this period of time, he has gained many skills and expertise on the whole life cycle of the tax returns from filing and processing of the returns, exam selection, field exam, to post-exam case processing

Yutian Zhang

Certified Public Accountant (CPA), CAA, President of KSLZ Accounting Firm

Zhang Yutian, CPA/CAA, founder and president of KS&LZ Accounting Firm, has 20 years of experience managing the accounting and financial operations of small to medium-sized companies and non-profit organizations. By enhancing accounting procedures, financial reporting, and capital management, Yutian strengthens the financial framework of company operations, contributing to a more strategic macro-planning for overall development.

Yutian has extensive experience in handling client audits, including planning, preparing financial statements, and coordinating on-site with auditors.

Sam Liang

CPA, Director at Alvarez and Marsal Tax

Sam Liang is a Tax Director with Alvarez & Marsal Tax with the West Palm Beach office. He specializes in tax compliance and consulting for corporate, pass-through, and high net-worth individual clients with international tax issue. His primary areas of concentration are U.S. taxation and tax reporting for cross-border transactions.

With more than10years of experience in taxation and accounting, his clients span a range of industries including private equity, crypto, technology, biotech, healthcare, e-commerce, distribution, retail trade, manufacturing, real estate, professional services, education, and non-profit.

Mr. Liang advised clients on transactional structuring, the design of global related entities structure, and financial and tax reporting. Mr. Liang also represented clients before IRS and state departments for various tax issues.

Prior to joining A&M Tax, Mr. Liang was a Tax Manager at HBK CPAs and Consultants. Before that, he was a Tax Manager with Deloitte. He also worked with PwC (PricewaterhouseCoopers) and KLR(Kahn, Litwin, Renza & Co., Ltd).

Mr. Liang earned a master’s degree in accounting from the University of Massachusetts. Mr. Liang is a Certified Public Accountant and a member of the AICPA.

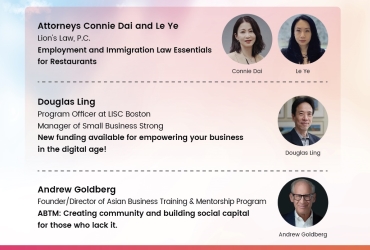

Yun Cheng

Attorney at Lion's Law Firm

Attorney Cheng practices in a variety of areas with Lion’s Law. He represents corporate and individual clients in civil and commercial litigations.

He assists clients with various legal issues involving breach of contract, landlord & tenant disputes in both residential and commercial leases, misrepresentation, breach of fiduciary duties, defamation, wrongful termination, and the Massachusetts Consumer Protection Act Chapter 93A. His skill set and experience in legal research, motion drafting, deposition, and oral argument enables him to successfully defend his clients’ rights through both litigation and settlement.

Co-Hosted by:

- Massachusetts Asian Restaurant Association (MARA)

- Chinese Consolidated Benevolent Association of New England (CCBA)

- New England Chinese Information and Networking Association (NECINA)

- Chinese Culture Connection (CCC)

- New England Chinese American Alliance (NECCA)

- Chinese American Association of Lexington (CAAL)

Don't miss out on this incredible opportunity to elevate your understanding of tax matters, connect with industry experts, and position yourself for financial success. Register Now!

Please click HERE or scan the QR code below to register.